You've got goals. We've got solutions.

Spending & saving

Do more with your money

Fidelity cash management products help you spend and save smarter so you can reach your goals.

Retirement

Your future starts now

Whether you want to manage retirement planning on your own or have us guide you, we’re here to help along the way.

Review Fidelity Brokerage Services with FINRA's BrokerCheck

Get started with some of our most popular accounts

Whether you want to invest on your own, or have us do the work, we have account choices for you. And we’ve got tools and resources to help along the way.

Retirement IRAs

Rollover IRA

Roth IRA

Traditional IRA

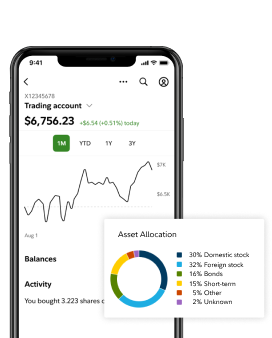

Investing & Trading

Brokerage Account

Spending & Saving

Cash Management Account

Investing account

FDIC-insured savings account

Chart is a hypothetical comparison. Investing involves risk of loss and performance is not guaranteed.

Best Online Broker for Beginning Investors

2023

Rated #1 for Overall Broker

2023

Best Online Broker

2023

Questions?

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

For a distribution to be considered qualified, the 5-year aging requirement has to be satisfied, and you must be age 59½ or older or meet one of several exemptions (disability, qualified first-time home purchase, or death among them).

Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

The Fidelity Cash Management Account is a brokerage account designed for spending and cash management. It is not intended to serve as a customer's main account for securities trading. Customers interested in securities trading should consider a Fidelity Account®.

Fidelity Go® provides discretionary investment management, and in certain circumstances, non-discretionary financial planning, for a fee. Advisory services offered by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. FPWA, FBS and NFS are Fidelity Investments companies.

Fidelity was named NerdWallet's 2023 winner for Best Online Broker for Beginning Investors, Best Online Broker for IRA Investing and Best App for Investing. Results based on evaluating 17 brokers per category. ©2017-2023 and TM, NerdWallet, Inc. All Rights Reserved.

StockBrokers.com 2023 Online Broker Review, January 2023: Fidelity was ranked No. 1 overall out of 17 online brokers evaluated in the StockBrokers.com 2023 Online Broker Review.

Investopedia, February 2023: Fidelity was named Best Overall online broker, Best Broker for ETFs, and Best Broker for Low Costs, among 25 companies.